Ohio Hotels: The 2025 Energy Data Every Owner Needs — And No Supplier Publishes

2025 Ohio Utility Price-To-Compare (PTC)

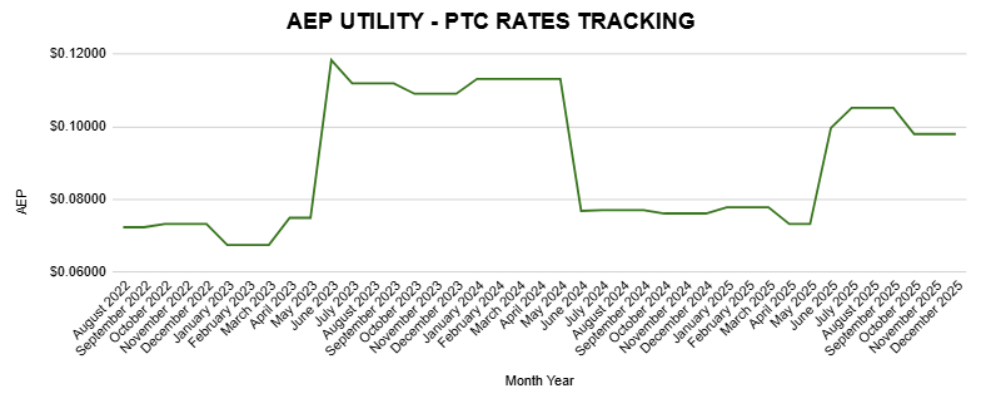

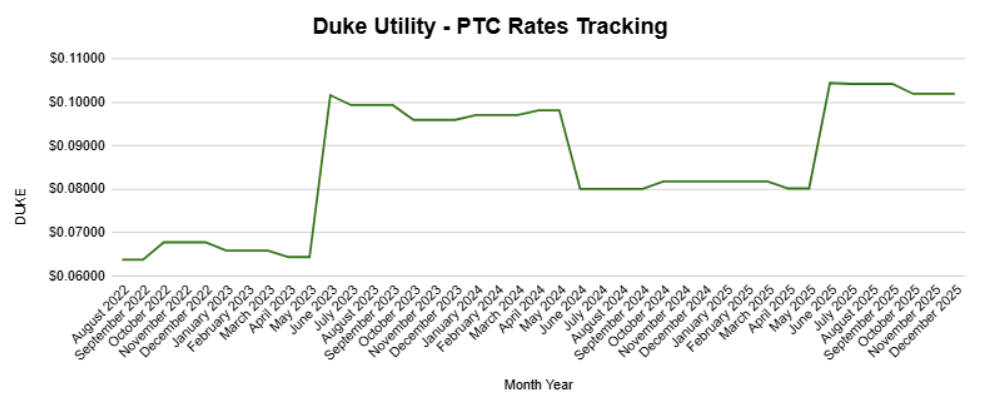

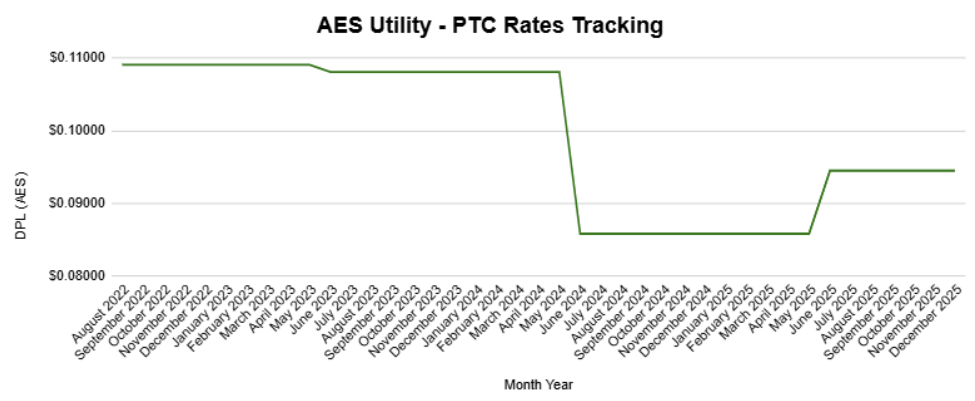

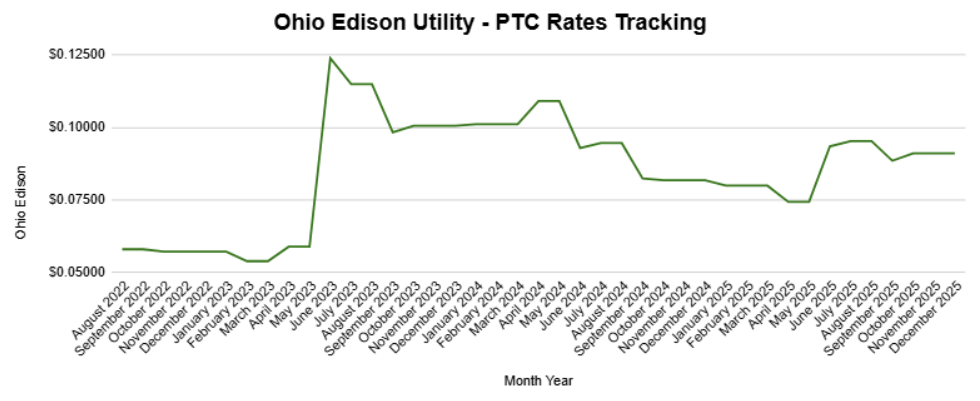

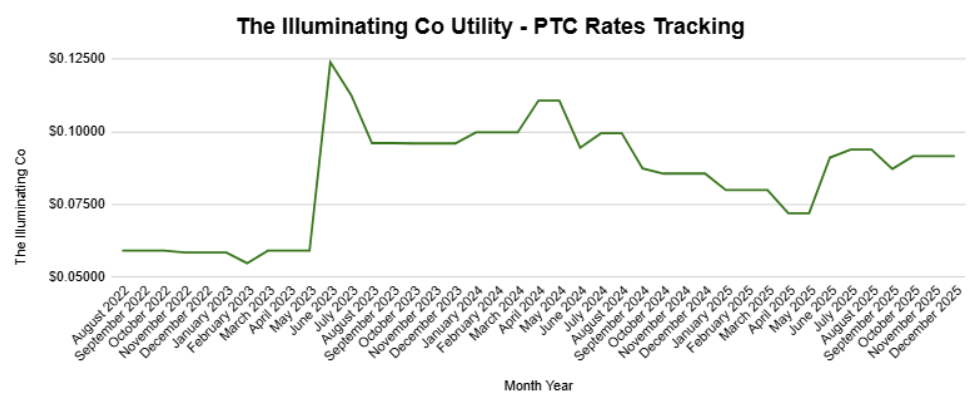

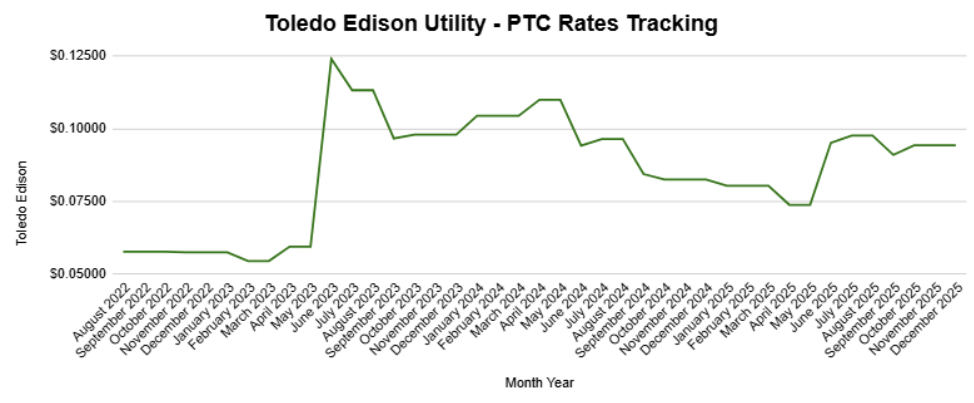

Let's begin by understanding where your utility's default rates (PTC) have been historically. As early as August 2022, our team has been tracking the average default prices the Public Utility Commissions of Ohio (PUCO) have been publishing, so the graphs/rates you see below are directly sourced by PUCO. Regardless of where you're located in Ohio, you'll notice that energy prices peaked in 2023-2024, and are peaking again as of June 2025.

Real Pricing Trends We're Seeing for Ananta Clients

In 2025, Ananta Energy Source was responsible for pricing and hedging 235 different entities, most of which are exclusive to hospitality energy accounts. As many of you are aware, we've been very vocal of the two most popular energy products:

- Full-Requirement Products

- Traditional all-in fixed rates that include Capacity costs with suppliers who WILL NOT adjust the rates

- **NEW** Fixed-Energy Product w/Capacity Pass Through (PT)

- Similar to the traditional product, but excluding capacity costs, which are now appearing as an additional line item (roughly 2 pennies [aka $0.02/kWh] on average)

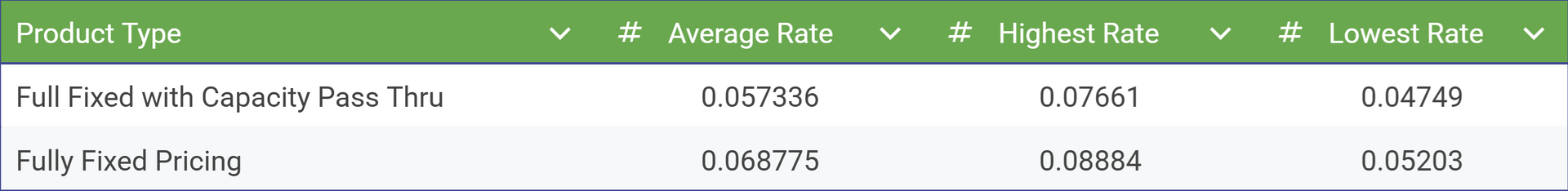

Out of the 235 entities, 119 entities (51%) elected to renew/sign-up with the traditional Full-Requirements product, and the remaining 116 entities (49%) elected to renew/sign-up with the New Fixed-Energy Product w/Capacity PT. Below are the average rates along with the highest and lowest rates for both product types:

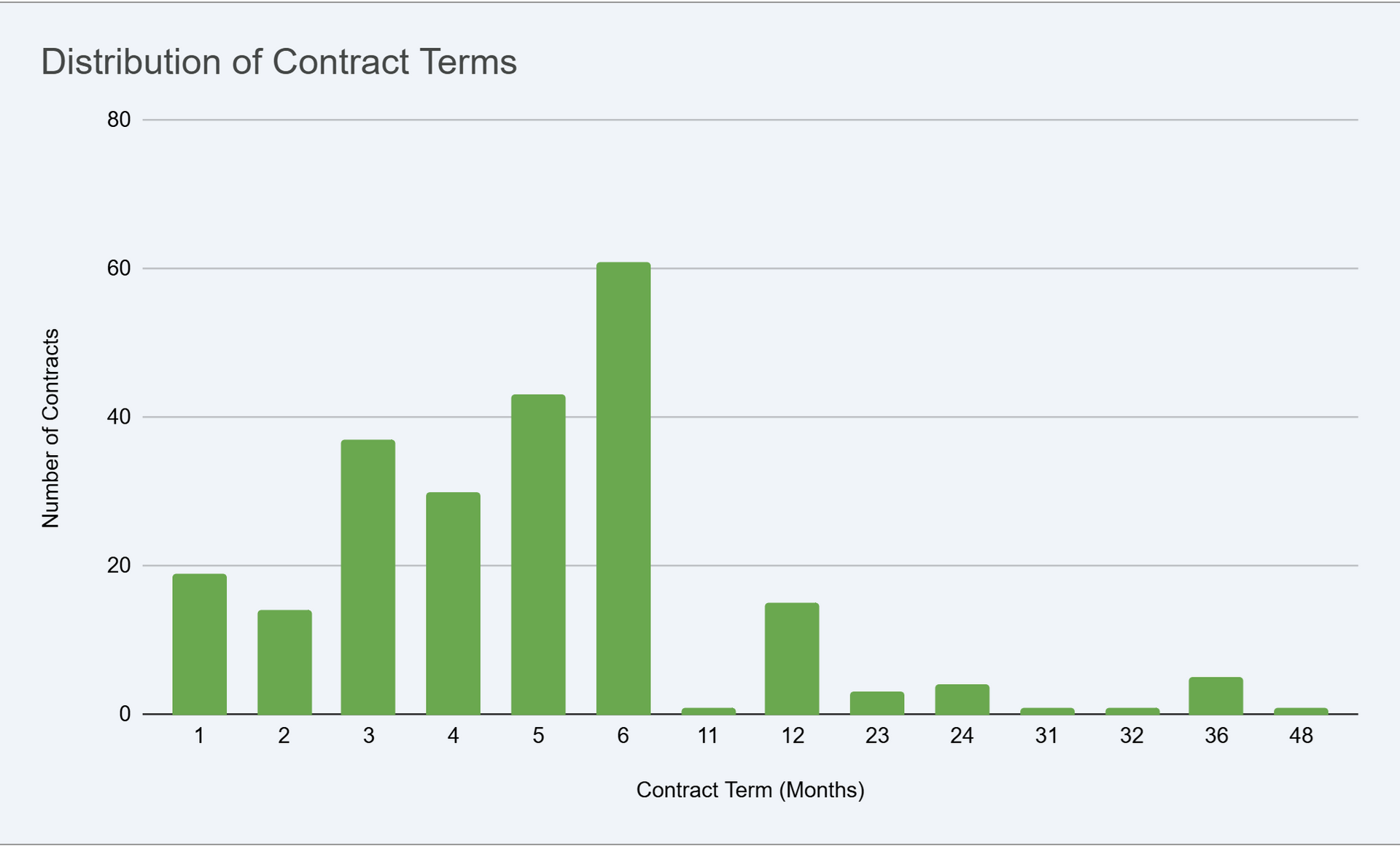

Hedged energy rates depend on market timing and your hotel’s unique load factor. Just like fingerprints, no two hotels use energy the same way—so pricing is always individualized. Also, please note that there is a very strong correlation between short-term deals in 2025 being way cheaper and a very strong correlation between long-term deals being the most expensive. Hence, please don't skew the data and think a hotel owner was able to find a $0.05203/kWh Fully Fixed rate with capacity included for 5 years.

Below is a bar-chart describing the contract term length our clients elected to enroll for 2025. As you can see, many individuals chose to do short-term energy contracts vs. long-term since the rates were notably cheaper (ie: $0.015/kWh - $0.025/kWh cheaper). With the market being in contango, everyone has to pay a large premium to lock in for the long-term, and this very typical in a bullish market.

How Current Supplier Bids Compare to These Benchmarks

Not much has changed in pricing offers with respect to the term and months you're heding.

For our clients who were bullish and had a low risk-tolerance in 2025, elected to go long-term, the Full-Requirement rates we presented throughout 2025 were in the mid 7 to mid 8 range (ie: $0.075/kWh - $0.085/kWh).

For everyone else we presented to, the new Fixed-Energy Product w/Capacity PT, a majority of terms that extended into 2026 were over 6 cents and ranged between 6 - 7 cents (ie: $0.06/kWh - $0.07/kWh)

What does this mean?

In simple terms, the long-term rates we tried to avoid earlier in the year — because they carried a $0.015–$0.02/kWh premium — are now roughly the same rates we’re being forced to consider today.

The bad news?

These prices are still higher than what hotels were used to seeing historically.

The good news?

They remain lower than the $0.09–$0.10/kWh utility default rates that Ohio hotels have been paying since June 2025, which still gives our clients meaningful savings compared to staying on utility supply.

Final Thoughts

I’ve said it before, and I’ll say it again: 2025 has easily been one of the most challenging and interesting years we’ve seen in energy procurement. I’ve joked in almost every meeting that we’re all “going back to school,” because this year forced everyone — brokers, hotels, suppliers, analysts — to relearn how these products actually work.

For nearly two decades, most hotels relied on the same product: the traditional Full-Requirements fixed rate that included capacity. Then the market shifted, and suppliers introduced something completely new: Fixed Energy with Capacity Pass-Through (PT). Overnight, the industry had to adjust. And because PT separates capacity into its own line item, understanding whether it benefits a customer requires actual data — not guesswork.

This is where participation matters. Capacity PT can only be evaluated properly by reviewing real invoices, month by month. For clients who send invoices immediately, thank you — seriously. You make deeper analysis possible. For those who are stretched thin (which is most hotel owners right now), we totally understand; just know that delays understandably slow down how quickly we can complete the math.

To give some perspective:

- 116 entities enrolled in Capacity PT earlier this year.

- That’s five months of invoices each (June–October).

- That’s 580 invoices my team has to review, calculate, and compare against wholesale capacity values. It’s a massive lift, but it’s the only way to get real answers.

At Ananta, we take pride in being transparent and data-driven, and in helping clients make decisions based on their risk tolerance, usage patterns, and actual numbers. That’s always been our style — open-book pricing, no fluff, no pressure.

Right now, we’re still waiting on a few more suppliers to return aggregated pricing, while simultaneously managing nearly 60 December expirations so no one accidentally ends up on a variable default rate.

More updates are coming as new information arrives. Thank you, truly, for your trust and patience during one of the most complex energy years we’ve ever experienced.